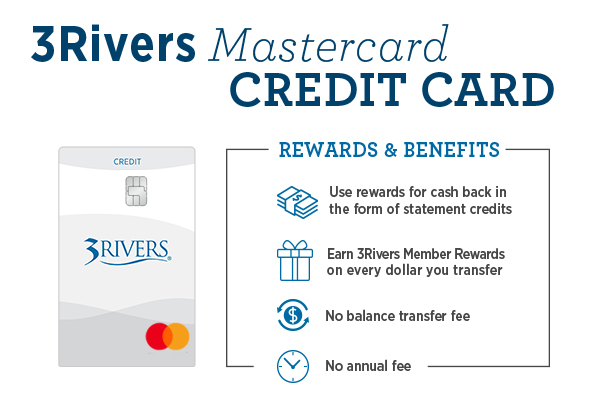

3Rivers Mastercard

You don’t need multiple cards to get the rewards you want. The 3Rivers Mastercard® credit card lets you choose between cash back1, merchandise, gift cards, and travel. We make it easy and give you all the rewards in one easy-to-use card!

There's no balance transfer fee2 and no annual fee2. Plus, the 3Rivers Mastercard credit card is equipped with EMV chip technology to help keep your personal and purchase information more secure.

Managing Your Credit Card

Contrary to the advice you may have heard about credit cards being dangerous and harming your credit, this is only the case if and when they're not used effectively. Spending mindfully, making on-time payments, and more can actually help to improve your credit over time!

The Truth about Minimum Payments

When you open your credit card statement and see the dollar amount next to “Minimum Payment Due,” it’s easy to assume that you don’t really need to pay more than that amount. While it's true that you don't have to pay more than the minimum monthly payment, here's a healthy financial habit that card companies may not always tell you: you can pay more than the minimum. And you should.

It’s true! You can pay as much as you want. In fact, if you’re able, you can pay the entire balance of your credit card each month, then you won't have to pay on interest!

Here's an example of how paying more each month will save you in the long run:

Credit Card Balance Payoff Example: $5,000 | Rate: 12.45%

| Payment Per Month | How Long To Pay Off? | Total Interest Paid |

|---|---|---|

| $75.00 | 9 years, 6 months | $3,549.40 |

| $150.00 | 3 years, 6 months | $1,167.66 |

| $500.00 | 11 months | $306.79 |

*Calculations were created from using the following calculator https://www.creditcards.com/calculators/payoff.php

So you may wonder why we don’t force you to pay the whole balance if it’s the best way to pay. We know that it’s not always possible to pay the entire balance, so we want to give you a flexible way to pay your bill each month. For that reason, we’ll let you pay as little as 1.5% of your balance as your minimum payment. But remember that your best bet will always be to pay more than the minimum each month. That’s how you can eliminate debt quicker and pay less interest over the life of your credit card.