Money Matters Blog

-

A Voice for the Good: A Mother's Hope

Oct 1, 2024This article features A Mother's Hope, a local non-profit on a mission to shelter pregnant women who are experiencing homelessness and provide life-changing opportunities for growth.

-

How to Work Little Treat Rewards into Improving Your Financial Health

Gone are the days of equating indulgence with financial folly; we're here to set up a strategy of little rewards as a secret ingredient to a healthy financial recipe...

-

Master Your Money Skills by Finding Your Financial Blind Spots

Let’s delve into the idea of financial blind spots, explore some common examples, and consider strategies for uncovering obstacles that may be lurking along our financial pathways....

-

Discover the Credit Union Difference!

Whoever said banking needed bankers? What if, instead of shareholders, profits were shared equally with the people actually doing the banking?...

-

Bitcoin 101: Answers to Your Questions About the Digital Currency That’s Going Mainstream

By now, you've likely seen the term "bitcoin" showing up all over your social media feeds and newscasts, and may be wondering what exactly this trending form of money is and why so many people have begun investing in it....

-

Creating a Financial Stategy for the Holiday Season

A study published by Healthline in 2015 showed 53% of millennials considered money to be the leading cause of stress during the holidays. Last year, another study found that 45% of Americans would prefer if Christmas didn’t come due to financial strain. If you are worried about money this holiday season, read on for some tips and tricks to help you stretch your dollars, and don’t hesitate to ask for help in creating a plan! Our excellent branch staff is equipped to help you with your money matters – during the holiday season and all year long....

-

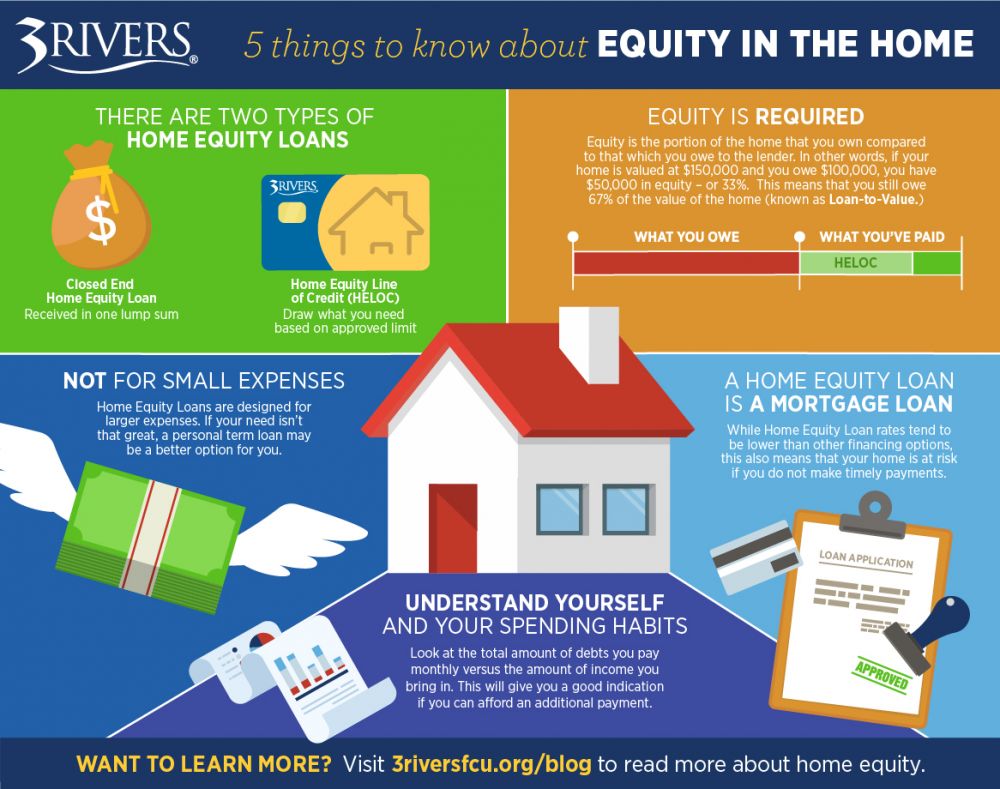

5 Things to Know About Equity in the Home

Thinking about taking out a home equity loan? Here are five things you should know before moving forward....

-

Watch-it-Wednesday: What is a Dividend?

Have you ever received a financial statement that includes the term "dividend" and wondered what it means? Here's the answer!...

-

Watch-it-Wednesday: Check Out Our Financial Literacy Video Library!

We know that you don't always have time to research and read lengthy articles about basic personal finance. That's why we've condensed a few very important financial topics down into short videos that you can watch anytime, anywhere....

-

How-Tuesday: How to Create Strong + Secure Passwords Online

Today, more than ever before, it's crucial that we take the time to create strong and secure passwords to ensure our online accounts are better protected from online hackers and security breaches. Here are a few tips to keep in mind when creating great passwords and keeping them safe....

-

Watch-it-Wednesday: North American Free Trade Agreement (NAFTA) Explained

If you've been following this year's campaign trail, then you've likely heard NAFTA brought up in various discussions. Struggling to recall what you learned in your US and World History courses about how the North American Free Trade Agreement works, and what it means for economic growth, the wealth of the countries involved, and more?...

View more Financial Basics Articles

Your Money-

How to Work Little Treat Rewards into Improving Your Financial Health

Gone are the days of equating indulgence with financial folly; we're here to set up a strategy of little rewards as a secret ingredient to a healthy financial recipe...

-

Master Your Money Skills by Finding Your Financial Blind Spots

Let’s delve into the idea of financial blind spots, explore some common examples, and consider strategies for uncovering obstacles that may be lurking along our financial pathways....

-

Which Checking Account is Right for You? Explore Our Options!

Are you in the right checking account for your current financial needs and spending habits? Here's a look at the checking solutions 3Rivers has to offer!...

-

Turning Your Money-Related Emotions into Positive Actions & Possibilities

The emotions you feel when it comes to your money are valid and not to be taken lightly. Fortunately, there are ways you can embrace them, grow from them, and turn them into possibilities for better financial experiences in the future, and 3Rivers can help!...

-

Savings Are Up: Let's Keep It, Name It, Feel It & Grow It!

It’s crucial for those who are fortunate enough to grow their savings (emergency or otherwise) during this time to have a solid plan that will keep them on track, now and in the future. Here are four ways to be more intentional about growing your savings....

-

14 Ways to Save Money by Going Green

Going green pays off in several ways. It reduces our carbon footprint and helps out the environment. It can benefit our health. And as an added bonus, it can save us some major money!...

-

Free Tax Resources Via the IRS Website

If you’ve ever had tax questions or have been referred to a tax preparer (or your TurboTax Assistant), there’s another way you may be able to get your tax-related questions answered free of charge: the Interactive Tax Assistant (ITA) tool, provided by the IRS!...

-

How Your Money is Insured at 3Rivers

Image showing several bundles of hundred dollar bills. In short, the National Credit Union Administration (NCUA) and the Federal Deposit Insurance Corporation (FDIC) are two agencies of the United States federal government that provide nearly identical deposit insurance to credit union members and bank customers. You can learn more about the two agencies at this link....

-

Your Financial Peace of Mind in Trying Times

Our team at 3Rivers wants you to be able to focus on what matters most in trying times like these – your well-being and peace of mind. We strive to go above and beyond by listening to your concerns, helping you to come up with a plan, walking you through your options, and offering the support and encouragement you need to realize that everything will be okay....

-

Start Saving for Your Child’s College Education Now with a 529 Plan!

You might not have college on the brain if your child is only a few months or years old, but it's never too early to start thinking about the cost of their higher education. Start saving now and you'll lessen the financial stress and last-minute scrambling that could come when your son or daughter excitedly rips open an acceptance letter to their (very expensive) school of choice....

-

Master Your Money Skills by Finding Your Financial Blind Spots

Let’s delve into the idea of financial blind spots, explore some common examples, and consider strategies for uncovering obstacles that may be lurking along our financial pathways....

-

Are You Prepared to Start Making Student Loan Payments? We’re Here to Help!

Are you ready to start making student loan payments later in 2023? We're here to help!...

-

Which Checking Account is Right for You? Explore Our Options!

Are you in the right checking account for your current financial needs and spending habits? Here's a look at the checking solutions 3Rivers has to offer!...

-

You're Invited to Our FREE Virtual College Funding Seminars This April!

Our Youth & College Team is always here to help walk students and families through each step of the college journey, and this spring, we’re offering six FREE, virtual sessions focused on three key areas of the college funding process....

-

Community LEADERS: Developing 3Rivers Employees into Dynamic Community Trustees

Through the Community LEADERS program, select 3Rivers team members participate in four, day-long sessions that help develop the skills and knowledge they need to be effective leaders in their communities....

-

Manage Your Finances Anytime, Anywhere with 3Rivers Online & Mobile Banking

3Rivers' digital banking tools offer expense analysis, savings goals, notification preferences, education resources, and reliable card monitoring for better financial management....

-

4 Steps to Choosing the Right College for You

When it comes to choosing a college, it's important to take the time to carefully consider your options and make an informed decision. Here are some tips to help you choose the right school for you....

-

A Year of Giving: A Reflection of 3Rivers' Community Efforts in 2022

3Rivers is thankful and proud to be an active participant in the communities we serve, and to have had so many opportunities to continue doing so through lingering challenges presented by the pandemic and current economic environment....

-

The Student Loan Debt Relief Application is Now Open

The One-Time Student Loan Debt Relief application is now live! It’s a fast and easy application, and should take you less than five minutes to complete. Here are some things to know about the Student Loan Debt Relief Plan, qualifications, and application....

-

Beware of Student Loan Forgiveness & Cancellation Scams

Student loan scams are on the rise. Even more so since the announcement about the Student Debt Relief Plan. Here’s what to know and how to stay safe....

View more New & Noteworthy Articles

3Rivers Solutions-

3Rivers Members: We've Made Updates to How Your Loan Bills & Statements Are Delivered

This month, 3Rivers members will notice that we’ve made some changes to how loan bills and statements are delivered. We’ve implemented these changes to improve the accessibility and clarity of the information provided....

-

Which Checking Account is Right for You? Explore Our Options!

Are you in the right checking account for your current financial needs and spending habits? Here's a look at the checking solutions 3Rivers has to offer!...

-

Get Out & Explore This Summer with Help from 3Rivers!

Dreaming of spending some time on the water or exploring the Midwestern terrain this summer? Want to put down some roots at the lake? 3Rivers can help!...

-

Turning Your Money-Related Emotions into Positive Actions & Possibilities

The emotions you feel when it comes to your money are valid and not to be taken lightly. Fortunately, there are ways you can embrace them, grow from them, and turn them into possibilities for better financial experiences in the future, and 3Rivers can help!...

-

Stay Safe During Inclement Winter Weather: Do Your 3Rivers Banking From Home!

Do your banking from the safety of home during inclement winter weather with all of our digital banking solutions!...

-

3Rivers Business Members Can Save Time & Money with Remote Deposit Capture

Remote Deposit Capture allows our business members to complete their deposits from the comfort of their home or office, saving them valuable time by not having to make multiple trips to a branch each week. Through a desktop scanner and state-of-the-art software, our businesses are not only able to deposit funds quickly, but also have access to some phenomenal reporting functions and tracking....

-

Our Website Got a Fresh New Look!

As you've probably noticed, we've been working hard over the past year to redesign our website to better suit our members’ needs and it's gotten a fresh new look!...

-

How Your Money is Insured at 3Rivers

Image showing several bundles of hundred dollar bills. In short, the National Credit Union Administration (NCUA) and the Federal Deposit Insurance Corporation (FDIC) are two agencies of the United States federal government that provide nearly identical deposit insurance to credit union members and bank customers. You can learn more about the two agencies at this link....

-

Your Financial Peace of Mind in Trying Times

Our team at 3Rivers wants you to be able to focus on what matters most in trying times like these – your well-being and peace of mind. We strive to go above and beyond by listening to your concerns, helping you to come up with a plan, walking you through your options, and offering the support and encouragement you need to realize that everything will be okay....

-

Your Banking & Safety Options Amid Growing COVID-19 Concerns

The safety and wellness of our employees, our members, and the community is a top priority for 3Rivers. In the wake of COVID-19 (coronavirus) concerns – in our nation and around the world – we understand the need to have plans and options in place to keep our team members and those conducting business with us as protected as possible....

View more 3Rivers Solution Articles

Student Tips-

Choosing the Right College for You: 4 Key Factors to Consider

The key to a fulfilling college experience and a high sense of well-being after graduation doesn't solely depend on the prestige of the institution. Instead, factors such as engaging with inspiring mentors, embracing challenging projects, and participating in extracurricular activities play a significant role....

-

3 Tools to Find Relevant Scholarships

Several tools have been developed to streamline the scholarship search process, making it easier to uncover opportunities that can make higher education more affordable. Here are three essential tools to kickstart your scholarship search....

-

How to Make the Most of Your College Campus Visit in 2024

Visiting a college is an important step toward higher education. It offers a real-life feel of the school environment and academic life. This experience is invaluable in making an informed decision about where to spend the next crucial years of academic and personal growth. Check out our tips for making the most of your visit!...

-

Are You Prepared to Start Making Student Loan Payments? We’re Here to Help!

Are you ready to start making student loan payments later in 2023? We're here to help!...

-

4 Steps to Choosing the Right College for You

When it comes to choosing a college, it's important to take the time to carefully consider your options and make an informed decision. Here are some tips to help you choose the right school for you....

-

5 Tips for a Successful College Visit

Here are five tips to help you make the most of your college visit day....

-

The Student Loan Debt Relief Application is Now Open

The One-Time Student Loan Debt Relief application is now live! It’s a fast and easy application, and should take you less than five minutes to complete. Here are some things to know about the Student Loan Debt Relief Plan, qualifications, and application....

-

Beware of Student Loan Forgiveness & Cancellation Scams

Student loan scams are on the rise. Even more so since the announcement about the Student Debt Relief Plan. Here’s what to know and how to stay safe....

-

4 Options to Consider for More Financial Aid

If you have college funding gaps that need to be filled, there are still options for additional financial aid. We’d love to help you explore ways to get this semester paid for....

-

3 Common FAFSA Myths, Debunked!

As the April 15 deadline for filing the Free Application for Federal Student Aid (FAFSA) approaches, we want to share three more common misconceptions about the FAFSA....

_800_383.png?sfvrsn=afb0370a_1)

.jpg?sfvrsn=bd779a39_1)

.jpg?sfvrsn=70bff8f5_1)

.png?sfvrsn=27d6895d_1)